If you

don’t have a large CRA team, haven’t had much training, or just inherited your bank’s CRA program, you’re probably feeling a little overwhelmed. It’s hard to run a CRA program during the best of times, but it may seem impossible during a pandemic. This is especially true if you don’t have a solid CRA foundation. And without a unified interagency approach to the CRA, this task is even more challenging.

Luckily, we have a few resources to help you get started.

Start with the history of the CRA

If you’re new to CRA, start by grounding yourself in the history. The CRA was one of many laws passed by Congress in the 1960s and 1970s intended to expand access to credit and

combat redlining. This regulation is just as important now as when it was enacted in 1977.

Here are a few resources to get you started:

Understand the structure of the CRA

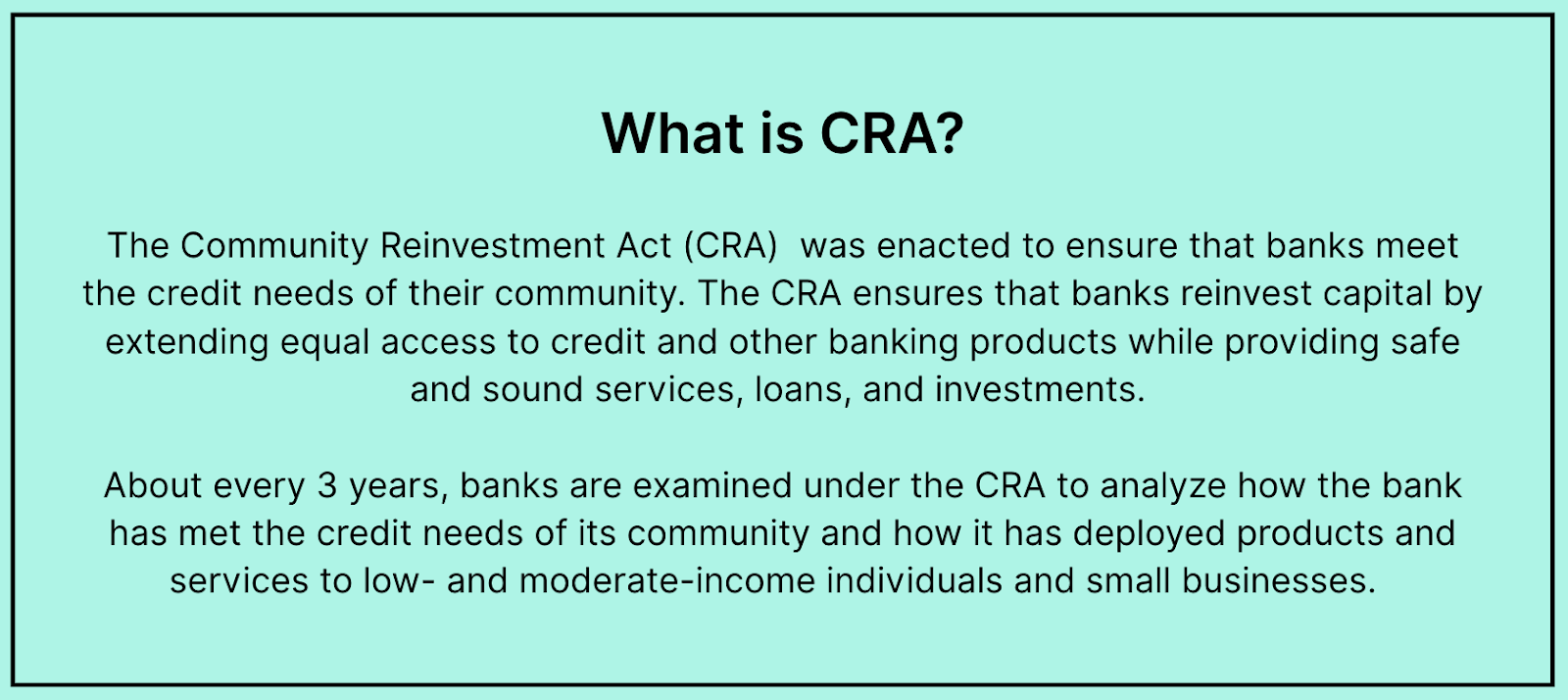

Once you understand the history of the CRA, you need to understand the structure and evaluative aspects of the regulation. A key part of the CRA is evaluating how a bank extends credit, offers services, and makes investments in the communities it serves.

Knowing what “counts” and how your bank will be evaluated is very important. Review your regulator’s guidance periodically to stay on top of any changes and updates. You can find each agency's CRA regulation at:

Here are two quick reviews of the regulation and its provisions:

Learn more about the CRA and how to run a CRA program

There are lots of ways to learn more about the CRA.

You can attend events like the

2021 CRA & Fair Lending Colloquium, the bi-annual National Interagency Community Reinvestment Conference (March 2022), and regional regulatory roundtables. These are all great sources of information.

Here are a few other valuable resources:

Reach out to other CRA officers

Running a CRA program may be difficult, but remember that

you don’t have to do this alone. There are plenty of other CRA officers out there who are struggling, and there are plenty of experienced CRA officers who can help. Reach out to your peers, ask questions, and work together to figure out this incredible—but sometimes overwhelming—work.

You’ve got this!

One of the hardest parts of the CRA is collecting, managing, and reporting all the data. If you’re feeling overwhelmed by this task or just want a better way to manage your CRA data, check out Kadince.

Kadince software makes it easy to track, manage, and report your CRA services, loans, and investments. Check out our

testimonials page to see how we’ve helped hundreds of banks manage their CRA data! Or, if you're ready to jump right in,

schedule a demo.

None of Kadince, Inc., its affiliates, or its respective employees, directors, officers, and agents (collectively, “Kadince”) are responsible or liable for any content or information incorporated herein.

Read full disclosure.