Loans

Managing and analyzing loans for CRA compliance can be time-consuming and frustrating. Spreadsheets and outdated software aren’t enough, and constant reminders to coworkers only add to the challenge. Luckily, there’s a better way.

Let us show you how Kadince can benefit your institution.

Thank you for your interest in Kadince! Your custom proposal will be emailed to you within four Kadince business hours.

Please ensure that your info is correct before submitting this form.

Thank you for your interest in Kadince!

May 13–16, | Salt Lake City, UT

Please ensure that your info is correct before submitting this form.

Please ensure that your info is correct before submitting this form.

Please ensure that your info is correct before submitting this form.

Please ensure that your info is correct before submitting this form.

Please ensure that your info is correct before submitting this form.

Please ensure that your info is correct before submitting this form.

Managing and analyzing loans for CRA compliance can be time-consuming and frustrating. Spreadsheets and outdated software aren’t enough, and constant reminders to coworkers only add to the challenge. Luckily, there’s a better way.

Import all loans into Kadince through system integrations or .CSV uploads.

Automatically identify small business, small farm, and home mortgage loans inside or outside your assessment areas, as well as potential community development loans.

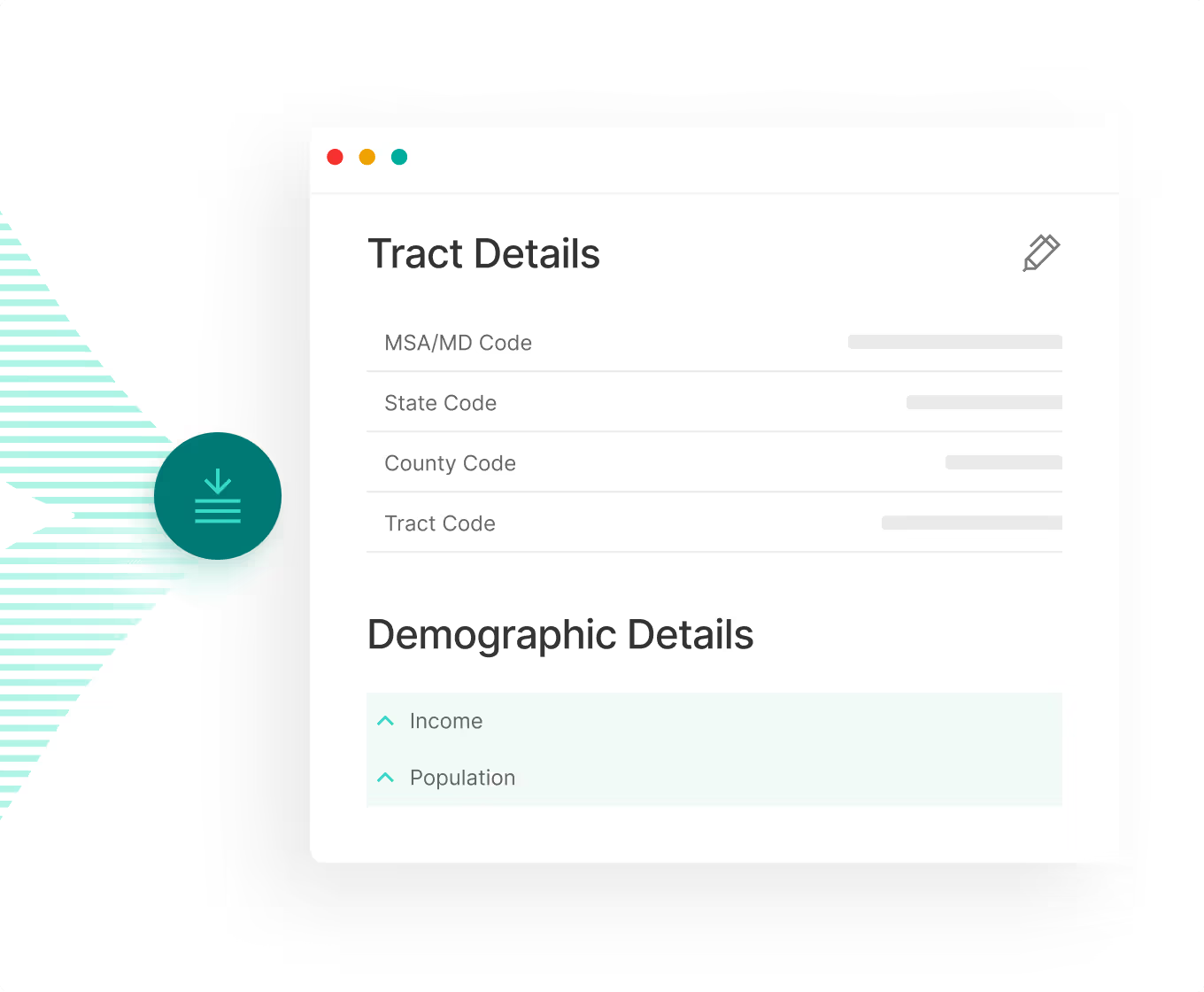

Auto-populate tract details like MSA, state, county, and tract code.

See demographic details, including income, population, and housing.

Create maps that visualize your loans to ensure equitable distribution and identify opportunities.

Automatically route loans to the appropriate reviewer(s) based on preset criteria.

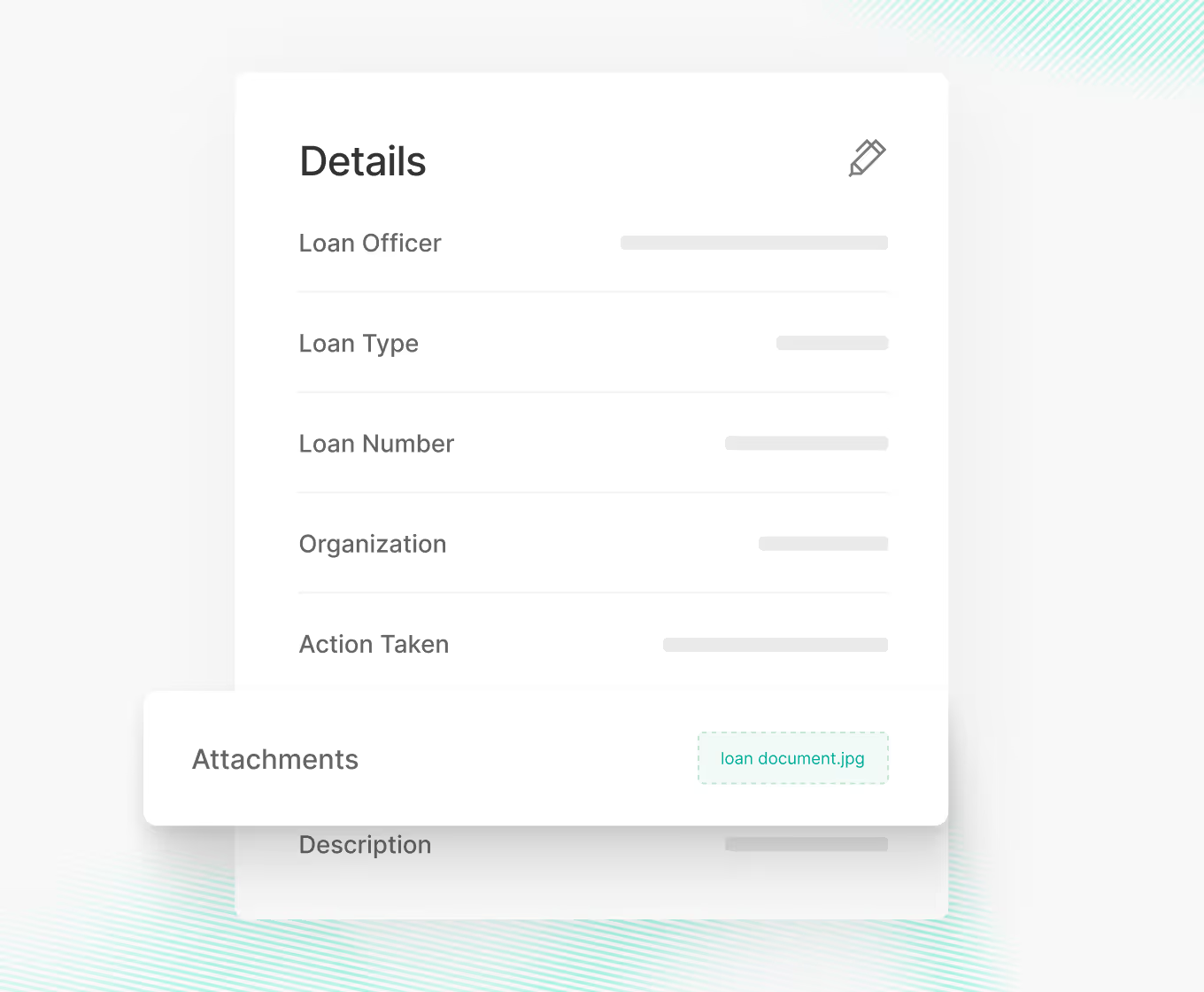

Add supporting documentation, impact details, and qualifying rationale to tell each loan’s story

Streamline reviews with workflows and logic to reduce manual intervention.

Use artificial intelligence to identify eligible loans and draft qualifying rationales.

Use real-time data to uncover lending gaps and monitor distribution trends.

Gain insights to strengthen CRA compliance and performance.

Generate reports to evaluate performance by assessment area, income level, or loan category.

Track progress over time to identify improvements and refine strategies.

Attach files directly to loans for seamless access and integration.

View supporting documents alongside loan data for better context.

Provide one-click access to documents in exam-style reports for examiners.

Keep documents organized and secure with a centralized system.

Create dynamic, real-time reports for geographic, revenue, income, and assessment area credit distribution.

Tailor reports for examiners, auditors, committees, and other stakeholders.

Share reports and maps effortlessly with team members or external parties.

Analyze strengths and weaknesses in CRA lending performance to improve outcomes.

Everything you need to succeed, so you can focus on what matters most.

Choosing new software is a big decision, but Kadince makes it simple. Intuitive, user-friendly, and built to streamline your processes, Kadince is the smart choice for your institution.